XAUUSD

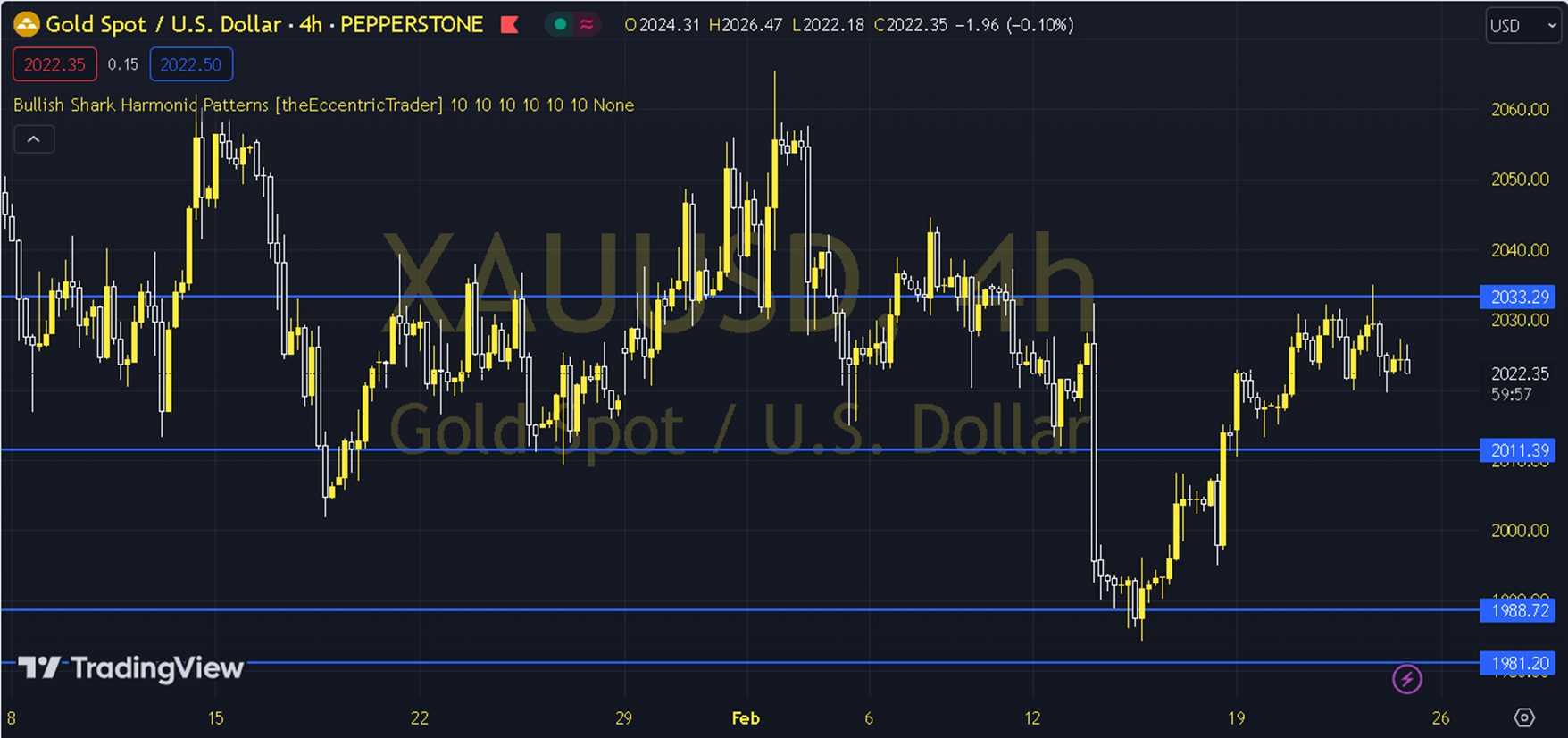

Following the leading manufacturing and services PMI data from the US, the ounce of gold has shown limited recoveries in the short term due to the effect of the 10-year treasury bond yield moving around 4.33%. When we technically evaluate the short-term pricing of ounce gold, we are following the 2021 level, which is currently supported by the 34 (2021) period exponential moving average. As long as the precious metal suppresses the desire to retreat at the 2021 level, the desire to rise may remain at the forefront. If the upward trend continues, there may be a movement area towards the 2030 and 2040 levels. At this stage, the attitude of the 2030 level can be monitored in terms of the continuity of the upward expectation. In the alternative case, in order for the negative expectation to come to the fore, it may be necessary to remain below the 2021 level. In such a case, the 2012 and 2003 levels may be encountered in the possible declines. Support: 2012-2003 Resistance: 2030-2040